Table Of Content

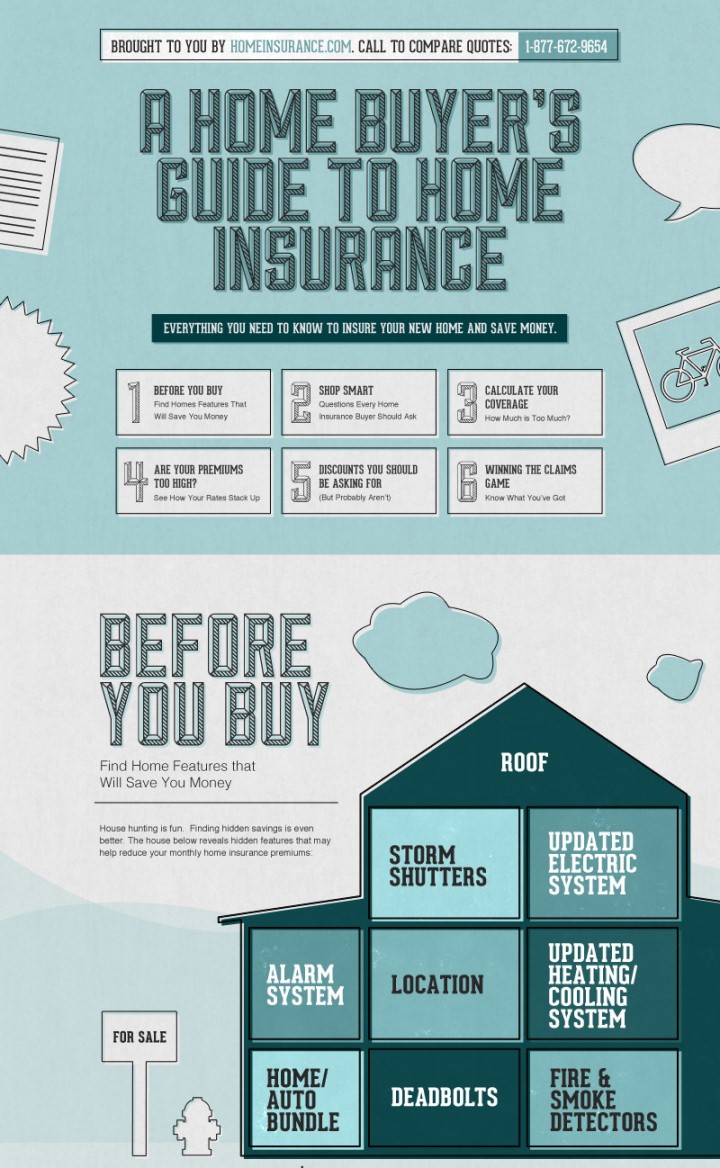

Yes, it’s possible your homeowner insurance costs may increase at renewal time after you make a claim. The type and severity of the claim and the total number of claims you’ve made can affect your home insurance costs. A credit-based insurance score is not the same as your personal credit score. By avoiding them when possible you can get cheaper home insurance rates. For example, some home insurers have a “trampoline surcharge” to account for the increased risk of insurance claims. Bundling insurance for your house and vehicles with the same company usually results in one of the best discounts you can grab, often between 5% to 25%.

Homeowners Insurance Guide

State Farm notes on its website that you can save up to $1,127 on auto and home insurance. If you have an auto insurance policy, State Farm notes that you can add a homeowners, renters, condo, or life insurance policy and save up to 17% on home insurance premiums. State Farm offers customizable homeowners policies that include optional coverage for pets, identity theft, and water backup. The state you live in may also determine what perils are excluded from standard home insurance policies. Regions with frequent threats of loss from tornadoes and hurricanes may have wind and hail exclusions. For example, Texas windstorm insurance is an endorsement purchased by many residents with homes near the Gulf of Mexico.

California homeowners insurance rates by city

Top 5 Homeowners Insurance Companies in Colorado 2024 - MarketWatch

Top 5 Homeowners Insurance Companies in Colorado 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

We offer protection for your home and personal property in addition to liability coverage if you're responsible for another person's injury or damage to their property. We connect you with a network of home insurance companies to give you more price and coverage choices when quoting. The availability and amounts of discounts can vary by company and your state.

Compare Homeowners Insurance Quotes FAQ

It's important that an insurer be financially sound so it can pay out claims promptly even in the event of a large-scale disaster. Best and Standard & Poor ratings offer insight into whether an insurer is financially sound. Homeowners should research discounts different insurers offer, so they can see which provides the lowest price coverage after all their savings is applied. This means buying multiple policies from the same carrier, such as buying both home and auto insurance.

The Average Home Insurance Cost in the U.S. for April 2024

Travelers is the best company for cheap rates, and Allstate has the best policy discounts. Be as accurate as possible when giving your information to insurance companies. If you misrepresent your home or your belongings to get a lower premium, you may be denied coverage or even charged with fraud. Most home insurance policies won’t cover damage from floods or earthquakes. Homeowners insurance coverage is a type of property insurance that provides financial compensation if your home is damaged by certain natural disasters, theft and/or accidents. This type of insurance does not cover flooding or earthquakes, which require a different type of coverage.

Earthquake insurance is for damage caused by earthquakes and other earth movement. In California, home insurance companies are required to sell earthquake insurance. In many states, you have the option to buy a standalone earthquake insurance policy or add extra coverage as an endorsement. If you have difficulty finding earthquake insurance in your state, you may need to contact an independent insurance agent. At a minimum, you’ll want enough coverage to fully rebuild your home, an amount known as replacement cost coverage.

What you need to know about wildfire insurance in California

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. For example, you might qualify for home safety discounts if your home has smoke detectors, deadbolts on all exterior doors, and fire and burglar alarms that alert local police and fire departments. Another common discount is a multi-line discount for bundling your auto and home insurance. You may be able to buy extra insurance to cover some of these problems.

Homeowners Insurance Cost Factors in California

The best way to find an affordable policy without sacrificing coverage is by comparing home insurance quotes from multiple insurers. The price for similar coverage can vary drastically among insurers, as you’ll see below. You can shop for quotes online or by phone, or you can work with an insurance agent or broker to find the cheapest home insurance for you. Whichever route you choose, make sure to compare policies with similar coverage and deductibles. By figuring out what you need before you compare home insurance companies, you can be sure each policy you’re considering provides the same level of coverage.

Learn more about our top home insurance companies by reading the brief summaries below and checking out our comprehensive reviews. We believe everyone should be able to make financial decisions with confidence. George Hosfield is senior director and general manager of home insurance solutions at LexisNexis Risk Solutions. In this role, he manages all aspects of the personal lines property business, including overall strategy, profitable growth, new product development and partnerships. He is responsible for several industry-leading data solutions, including LexisNexis® Rooftop and LexisNexis® Current Carrier Property®. George has been with LexisNexis for more than 20 years, working in a variety of operational and strategic roles in both the LexisNexis Legal & Professional and LexisNexis Risk Solutions divisions.

When hearing that location can influence home insurance costs, many people’s minds jump to state-by-state cost considerations. While the state you live in plays a role in the cost of your insurance, so does your ZIP code. The interactive map below shows home insurance rates from across the state to help you compare. Our research determined that the average cost of home insurance in California is $1,403 per year for $300,000 in dwelling coverage. You may want to shop early, and end your old policy on the same date your new one starts to avoid a lapse in coverage.

Appliance insurance via a home warranty plan is often worthwhile, as it protects you from unexpected repair and replacement costs if something breaks down. Provided you get coverage from a reputable company, you stand to save big on repair costs — an average of $200 per instance — and replacement costs — between $300 and $2,500, depending on the appliance. Most appliances are covered for just $2 per day, and you get good coverage limits of $500 per claim. Select also doesn’t have a cap for the number of repairs or service calls you make, which gives you total peace of mind that you’ll remain covered no matter what.

About 85% of homeowners insurance companies review your “credit-based insurance score” when calculating your rates, according to FICO. Our surveys show that the best homeowners insurance companies aren’t the ones that you hear about the most. “Conspicuously absent from our top tier of rated insurers are many household brands that dominate the advertising airwaves,” said David Gopoian, who oversaw CR’s homeowners insurance survey for over 25 years. Still, some homeowners may try to cut costs by saving on their home insurance, but this could prove challenging. According to proprietary premium data from Quadrant Information Services, the national average homeowners insurance rate for $300,000 is $2,151, which is a rise from 2023.

No comments:

Post a Comment